A Ready Reckoner To Real Estate Tokenization

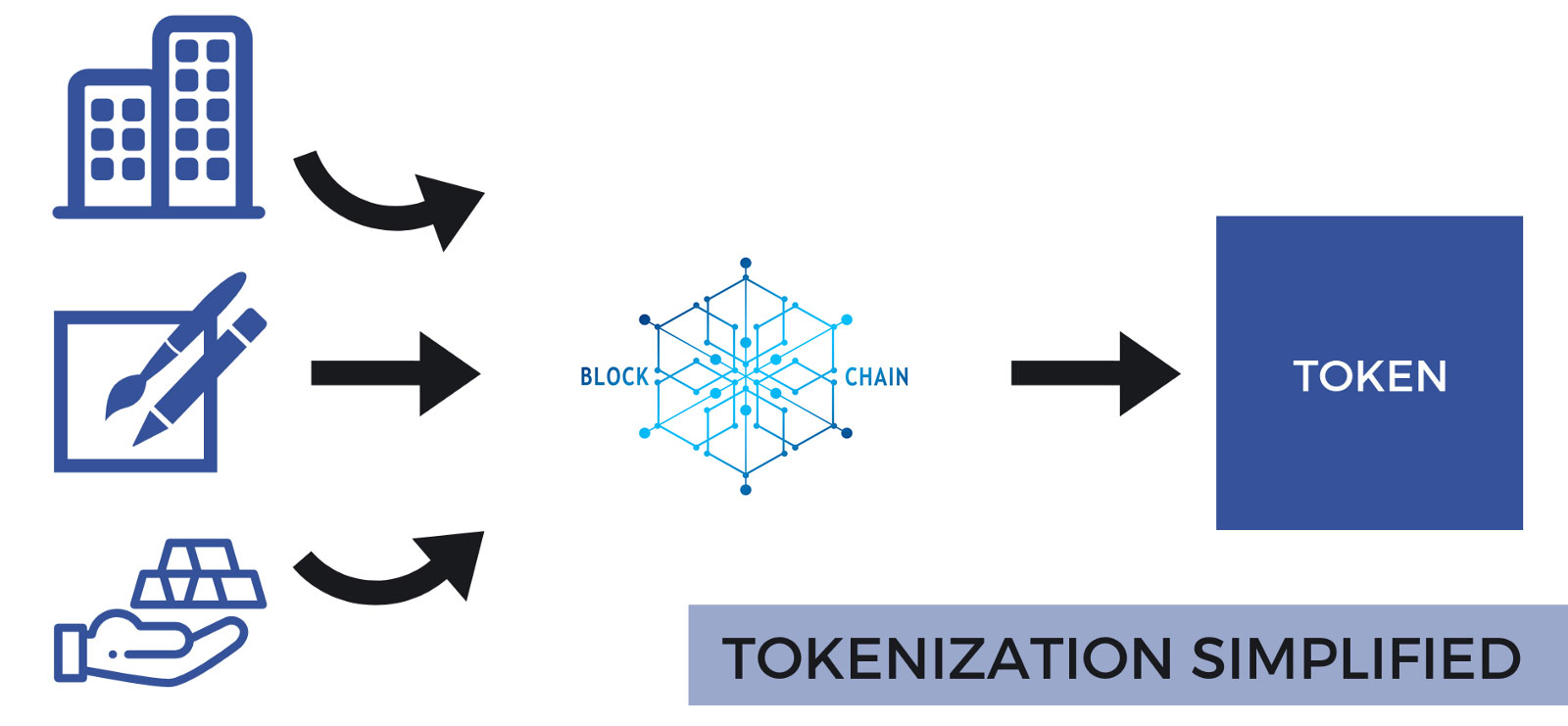

Real estate is one of the most valuable and profitable assets there is. According to a report, there is a significant growth in the professionally managed real estate sector. It was estimated that this market surpassed the $8.5 trillion mark in 2017. However, the property business still suffers from factors such as illiquidity, high costs, immobility, archaic documenting processes, and more. Luckily, the introduction of blockchain technology changes all this. Through the process of tokenization, the entire industry is reimagined and reshaped to suit the fast-paced trends of 2019. In a blockchain sense, tokenization simply means the conversion of real-world ownership rights into digital tokens. This process helps users overcome conventional problems while also promoting decentralization and greater mobility. Let us see how the tokenization of real estate assets benefits the industry: Sellers can liquidate large and expensive properties with ease Property documentation i...